Navigating Tariff Tangles: January 2025 HANDLS Monthly Report

Income Sector Navigates Tariff Tangles

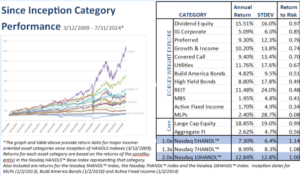

As of January 31, 2025, income categories have shown solid performance across various types, with Master Limited Partnerships (MLPs) leading the way. MLPs posted a robust 7.08% return for the month, continuing their strong momentum. The dividend equity space also performed well, up 3.26%, reflecting the steady demand for income-focused stocks with reliable dividend payouts.

The growth and income category delivered a similarly strong performance, up 3.19%, underpinned by a balanced mix of capital appreciation and income generation. Utilities, often seen as a defensive sector, saw a return of 2.89%, offering stability in a volatile environment. Covered calls, which provide income through option premiums, gained 2.50%, highlighting investor interest in enhanced yield strategies.

Preferred stocks posted a more modest return of 1.49%, while high yield bonds offered a 1.39% return, reflecting a cautious risk-on sentiment. Build America Bonds, a specialized category of taxable municipal debt, provided a return of 1.07%. REITs, which typically offer attractive dividends, lagged with a 0.76% return, possibly due to market concerns about interest rates.

Active fixed income strategies underperformed somewhat with a 0.69% return, while investment-grade corporate bonds saw minimal movement, up just 0.68%. Mortgage-backed securities (MBS) returned 0.56%, a reflection of the ongoing low-interest-rate environment.

The recent shift in tariff policies has added a layer of complexity to the economic landscape, potentially influencing market sentiment and investment decisions.

While tariffs can disrupt global supply chains, leading to inflationary pressures, they may also create opportunities in sectors like MLPs and utilities, where domestic focus and infrastructure may shield companies from some of the global risks. The large-cap equity space posted a 2.33% return, with the Nasdaq HANDL™ indexes performing well. The 5HANDL™ Index gained 1.60%, the 7HANDL™ Index rose 1.96%, and the 10HANDL™ Index increased by 2.77%, indicating that income-oriented strategies are gaining favor amidst broader market uncertainties.

The income sector has proven resilient, and with the growing volatility from tariff threats, yield-focused strategies are becoming key to navigating the road ahead. Investors are increasingly prioritizing income stability and diversification to achieve superior risk-adjusted returns.

Disclosure: Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2025. Nasdaq, Inc. All Rights Reserved

Important Disclosure. HANDLS Indexes receives compensation in connection with licensing its indices to third parties. Any returns or performance provided within are for illustrative purposes only and do not demonstrate actual performance. Past performance is not a guarantee of future investment results. It is not possible to invest directly in an index. Exposure to an asset class is available through investable instruments based on an index. HANDLS Indexes does not sponsor, endorse, sell, promote or manage any investment fund or other vehicle that is offered by third parties and that seeks to provide an investment return based on the returns of any index. There is no assurance that investment products based on an index will accurately track index performance or provide positive investment returns. HANDLS Indexes is not an investment advisor, and HANDLS Indexes makes no representation regarding the advisability of investing in any such investment fund or other vehicle. A decision to invest in any such investment fund or other vehicle should not be made in reliance on any of the statements set forth in this document. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Inclusion of a security within an index is not a recommendation by Indexes to buy, sell, or hold such security, nor is it considered to be investment advice. The information contained herein is intended for personal use only and should not be relied upon as the basis for the execution of a security trade. Investors are advised to consult with their broker or other financial representative to verify pricing information for any securities referenced herein. Neither Indexes nor any of its direct or indirect third-party data suppliers or their affiliates shall have any liability for the accuracy or completeness of the information contained herein, nor for any lost profits, indirect, special or consequential damages. Either Indexes or its direct or indirect third-party data suppliers or their affiliates have exclusive proprietary rights in any information contained herein. The information contained herein may not be used for any unauthorized purpose or redistributed without prior written approval from HANDLS Indexes. Copyright © 2025 by HANDLS Indexes. All rights reserved.